Key Takeaways

- USDe supply rose 70% and USDS rose 23% since the GENIUS Act, despite its prohibition on issuer-yield offerings.

- Yield-bearing stablecoins like sUSDe (10.86% APY) and sUSDS (4.75% APY) are attracting investors.

- Overall stablecoin supply may approach $300B by year’s end if trends continue.

Surprisingly, yield-bearing stablecoins have flourished despite the GENIUS Act banning direct token yield offerings in the U.S.

Investors are turning to platforms like Ethena’s USDe and Sky’s USDS, staking their holdings for high returns inside respective protocols.

GENIUS Act Winners Emerge in Stablecoin Growth

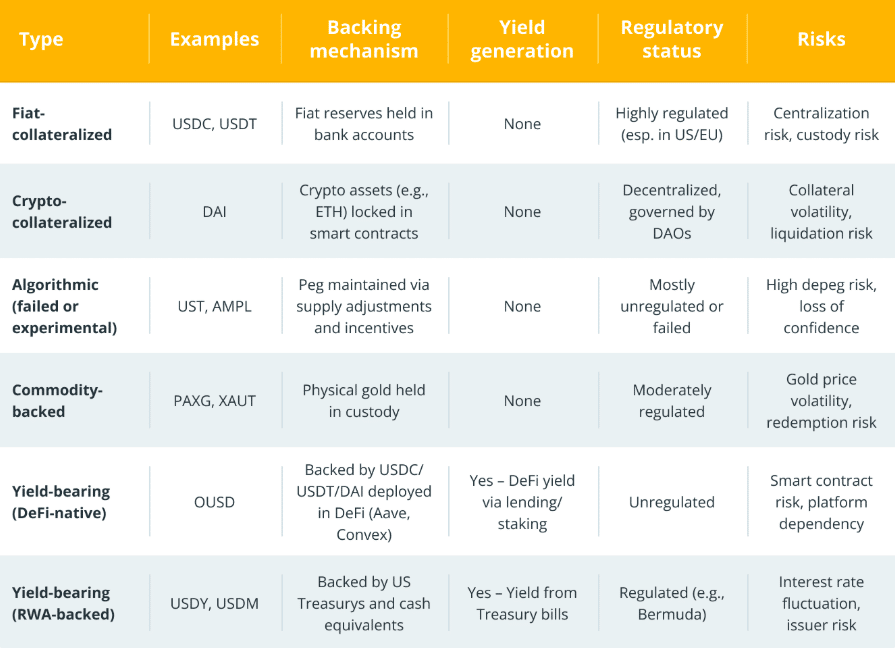

The law aimed to restrict direct crypto yields, but decentralized platforms pivoted by offering yield through three primary mechanisms.

- Lending protocols, such as Aave and Compound, allow users to earn interest by supplying stablecoins to a liquidity pool, with rates fluctuating based on supply and demand.

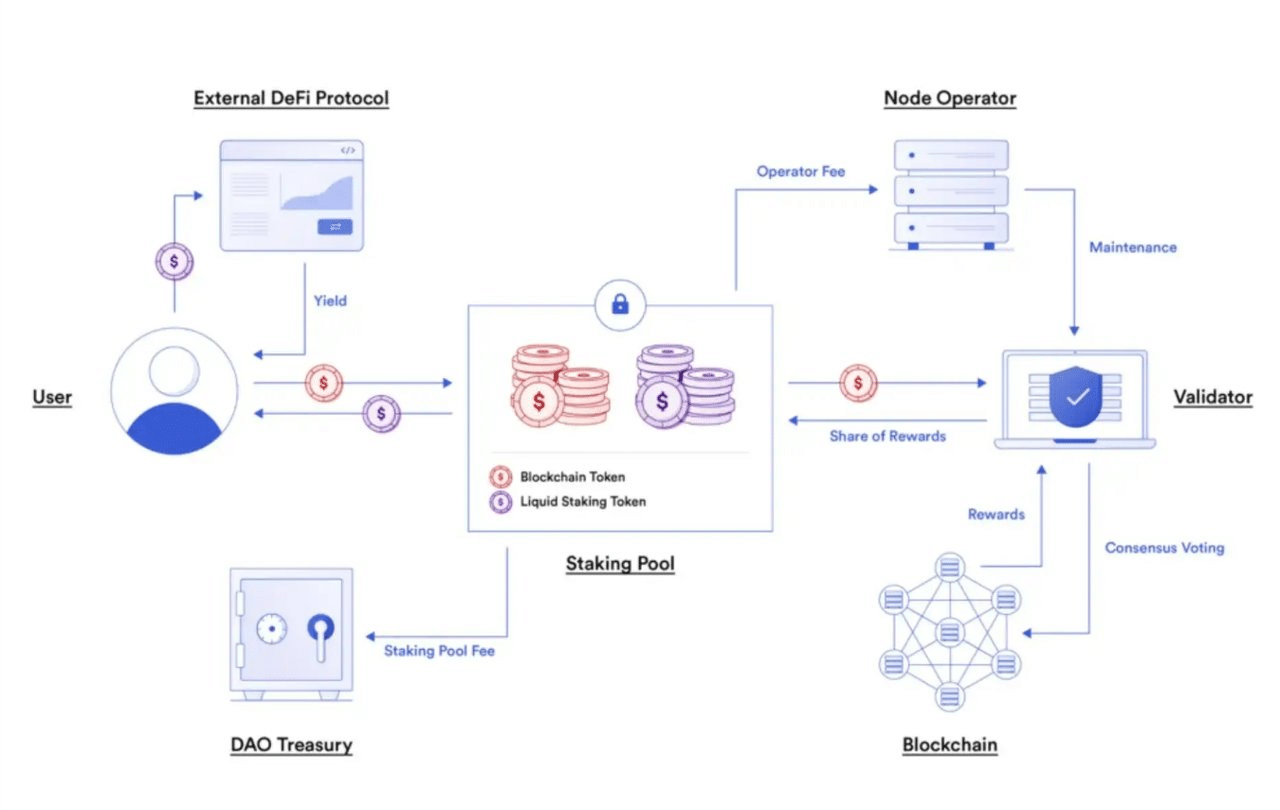

- Staking and liquidity protocols, including yield farming and aggregators, offer rewards and trading fees to users who lock their stablecoins.

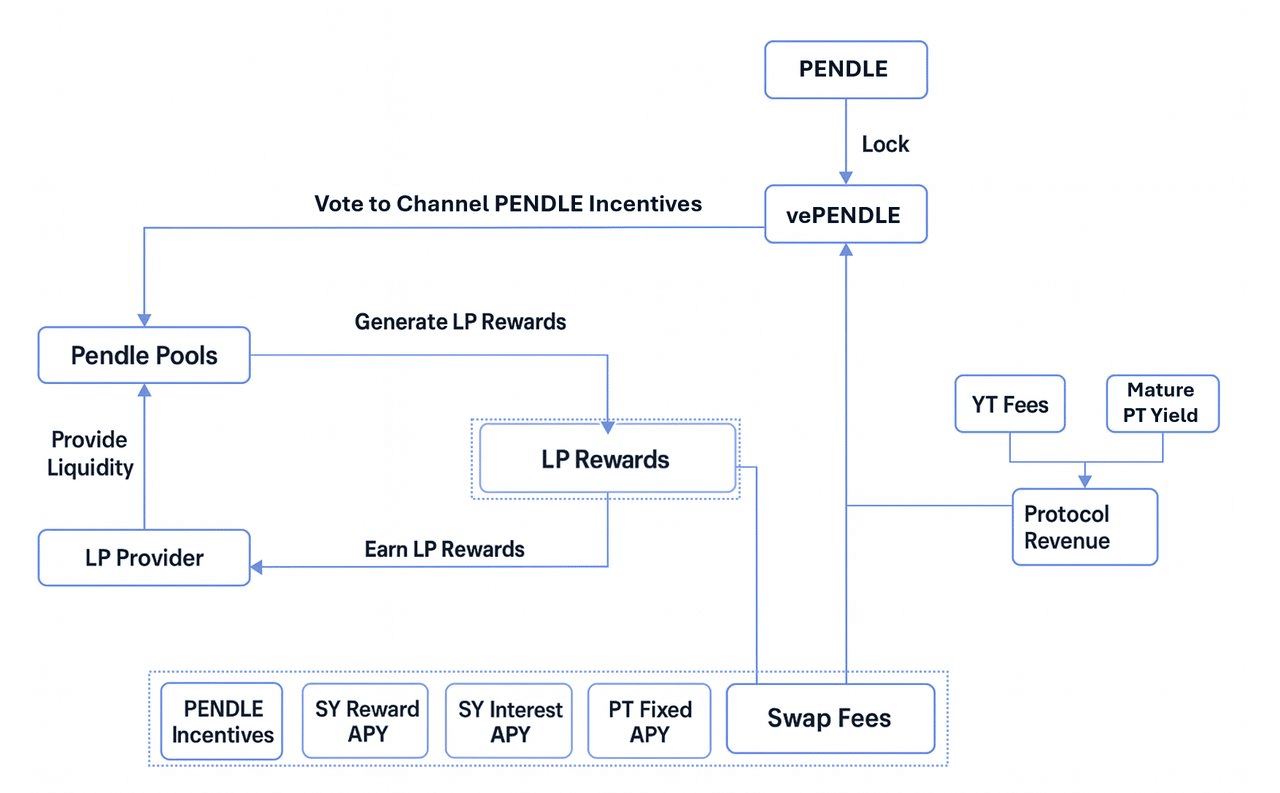

- Lastly, derivatives protocols like Pendle enable more complex strategies by allowing users to tokenize and trade the future yield of an asset.

Navigating Yield and Regulation

The pursuit of yield-bearing stablecoins is a high-stakes experiment, driven by user demand but increasingly complicated by regulation. Frameworks like the U.S. GENIUS Act and the EU’s MiCA are restricting direct interest offerings, forcing projects to innovate with compliant alternatives.

This creates a critical balancing act: delivering returns for users while navigating a complex regulatory landscape.

Stablecoins Face Traditional Finance Competition

The stablecoin market has grown significantly this year, with its capitalization nearing $300 billion. However, this growth faces a major headwind from traditional finance.

Banks and institutions are rolling out their own regulatory-safe tokenized alternatives, a move some are labeling “Operation Chokepoint 3.0.”

This strategy could see traditional finance hindering stablecoin growth by charging high fees for data and transfers, or even blocking crypto applications outright.

Final Thoughts

Yield-bearing stablecoins have emerged as unexpected beneficiaries following regulatory changes. The GENIUS Act inadvertently spurred staking-based returns that attract capital—but upcoming competition from tokenized financial instruments may shape how long this momentum lasts.

Frequently Asked Questions

Aren’t stablecoin yields banned now?

Yes—but yield is being generated through staking, not direct token issuance.

Can yields beat inflation?

Yes. sUSDe and sUSDS offer inflation-adjusted returns of ~8.16% and ~2.05%, respectively.

Could growth slow soon?

Possibly. Tokenized traditional finance products may siphon demand away.