Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

Coinbase To Introduce Tokenized Stocks And Prediction Markets For US Users

Coinbase is set to roll out tokenized stocks and prediction markets for US users in the coming months, intensifying competition with platforms like Robinhood and Kraken, per recent CNBC reports.

Coinbase has been pushing for SEC approval to offer blockchain-based equities, a move that could redefine retail access to private company shares.

Introducing prediction markets signals Coinbase’s ambition to diversify beyond crypto trading. It taps into speculative interest, potentially drawing a broader user base while challenging existing fintech giants.

SEC Chair Paul Atkins Launches Project Crypto Initiative, Says Most Crypto Assets Are Not Securities

US Securities and Exchange Commission (SEC) Chair Paul Atkins announced the launch of Project Crypto, a sweeping Commission-wide initiative to modernize securities regulations for crypto assets.

In support of President Trump’s vision to make the US the “crypto capital of the world,” the initiative aims to establish clear rules for the distribution, custody, and trading of crypto assets, while fostering innovation through tailored exemptions and regulatory flexibility.

Notably, Project Crypto will focus on several key areas, including creating clear guidelines for determining whether crypto assets are securities, developing purpose-fit disclosures and safe harbors for token distributions, modernizing custody requirements, and enabling “super-apps” that can offer multiple crypto services under a single license.

“Most crypto assets are not securities,” Atkins stated. “But confusion over the application of the ‘Howey test’ has led some innovators to prophylactically treat all crypto assets as such.”

The SEC will work with the Crypto Task Force to swiftly develop proposals implementing the PWG’s recommendations.

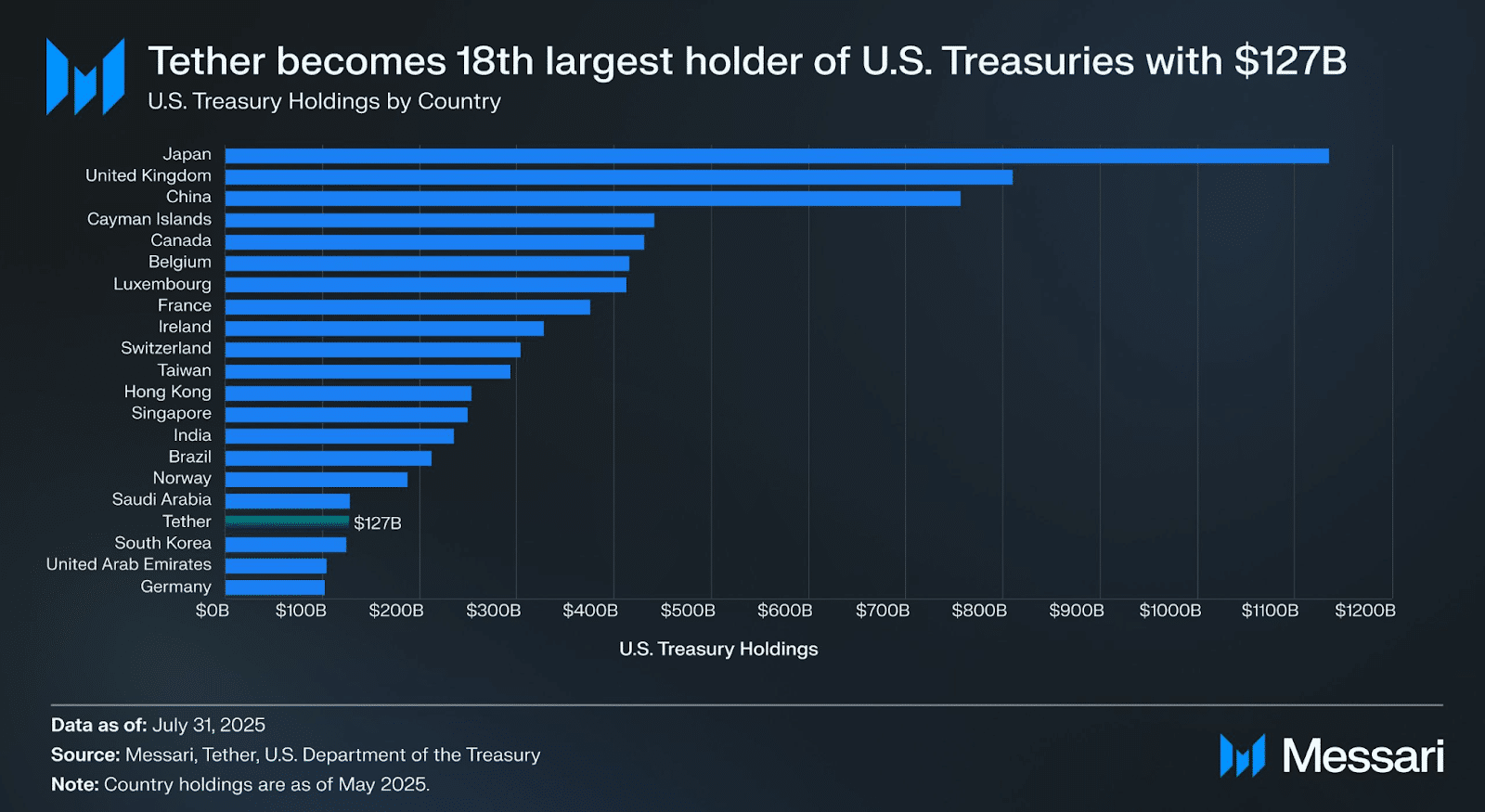

Tether Surpassed South Korea To Become The 18th Largest Holder of US Treasuries

Tether, the issuer of the world’s largest stablecoin USDT, has become the 18th largest holder of US Treasury securities, surpassing South Korea in this category with approximately $127 billion in holdings as of July 31st, 2025.

This includes $105.5 billion in direct Treasury holdings and an additional $21.3 billion in indirect holdings, a significant increase from its Q1 2025 reserves.

The development highlights Tether’s growing influence in global finance and reflects how major stablecoin providers are increasingly reshaping traditional financial ecosystems.

The company’s growing Treasury holdings and financial transparency suggest a strategic effort to align with institutional expectations while maintaining its market leadership. As Tether continues to grow its reserve assets and expand its US footprint, it is likely to face both opportunities and challenges in an increasingly regulated financial environment.

UK Regulator FCA To Open Retail Access To Crypto ETNs

The UK’s Financial Conduct Authority (FCA) is lifting its ban on crypto exchange-traded notes (ETNs) for retail investors, allowing trading on FCA-approved exchanges starting October 8th, 2025.

The FCA’s move reverses a 2021 ban on retail access to crypto derivatives and ETNs, aiming to balance investor access with market stability. This targets regulated UK exchanges like the London Stock Exchange.

Unlike US spot crypto ETFs, ETNs do not necessarily hold underlying assets directly. Instead, they are debt securities issued by financial institutions that promise to pay the holder a return tracking an asset’s performance minus fees and expenses.

Solana Mobile Seeker Smartphone Begins Shipping With 150K Preorders

Solana Mobile begins global shipping of its second-gen Web3 phone, Seeker, on August 4th, 2025, following over 150,000 preorders across 57 countries.

The device, priced between $450–$500, features hardware‑based Seed Vault, Genesis Token, and upgraded Solana dApp Store.

Leveraging the new TEEPIN architecture and launching its native SKR token, Seeker aims to redefine mobile Web3 experiences.

CFTC Kicks Off New ‘Sprint’ Initiative To Advance Trump’s Crypto Regulatory Roadmap

The Commodity Futures Trading Commission (CFTC) has launched a ‘Crypto Sprint‘ initiative to fast-track Trump’s vision for digital asset regulation, aiming for clarity and innovation in the US crypto space.

This new effort by the CFTC focuses on implementing recommendations from a presidential working group, prioritizing a regulatory framework that supports growth while addressing risks in the digital asset market.

Working alongside the Securities and Exchange Commission (SEC) on “Project Crypto,” the initiative targets 24/7 trading rules and DeFi clarity, signaling a joint push for a cohesive regulatory environment.

Barry Silbert Returns To Grayscale As Chairman As The Firm Prepares To Go Public

Barry Silbert, founder of Digital Currency Group (DCG), has returned as chairman of Grayscale Investments as the firm gears up for a potential Initial Public Offering (IPO).

“I’m honored to rejoin the Grayscale board at a defining moment for both the company and the broader digital asset ecosystem,” Silbert said. “I continue to have deep conviction in the company’s long-term positioning and in the leadership team guiding it forward.”

Silbert’s comeback follows his resignation in 2023, with Mark Shifke stepping down from the chairman role but staying on as a director.

Grayscale’s confidential filing for a US IPO, as reported recently, reflects growing confidence in crypto’s public market appeal, especially with Bitcoin hitting record highs. Silbert’s leadership could steer this pivotal transition.

Trump Could Soon Sign An Executive Order To Penalize Banks For Discriminating Against Crypto Firms

The White House is reportedly preparing an executive order to impose sanctions on banks that discriminate against or disadvantage customers for political and religious reasons, according to the Wall Street Journal (WSJ).

Notably, the executive order is said to require banks to revise their guidelines to ensure that certain industries, such as the virtual asset sector, are not excluded on the grounds of ‘customer reputation risk.’

According to the draft executive order secured by the WSJ, financial authorities will investigate whether financial institutions violate laws such as the Credit Equality Opportunity Act, the Antitrust Act, and the Consumer Financial Protection Act.

If violations are confirmed, penalties such as fines and consent orders can be imposed.

US SEC Updates Accounting Guidelines For Dollar Stablecoins

According to a Bloomberg report, the US Securities and Exchange Commission (SEC) has updated its staff guidance on accounting rules for stablecoins. The core of the new guidance states that if a US dollar-pegged stablecoin has a guaranteed redemption mechanism and its value stability is linked to another class of assets, it may be classified as a “cash equivalent.”

While the SEC is formulating broader cryptocurrency regulatory rules, this latest interim guidance is part of Chairman Paul Atkins’ efforts to lift restrictive measures.

For example, in April of this year, the SEC clarified that “covered” US dollar stablecoins are not considered securities and confirmed that entities engaged in the issuance and redemption of such stablecoins do not need to register these activities with the agency.

US SEC Says Certain Liquid Staking Activities Are Not Securities

The US Securities and Exchange Commission’s (SEC) Division of Corporation Finance clarified that some liquid staking activities, including issuance and redemption of receipt tokens, do not count as securities offerings.

When staking is structured through self, custodial, or delegated models without entrepreneurial efforts, it falls outside securities law. This gives clearer guidelines for compliant staking services.

The guidance applies to protocol-based and third-party provider models, provided their activities remain consistent with the outlined parameters. However, the SEC cautioned that liquid staking services extending beyond the described scope or involving additional managerial functions could still trigger securities laws.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!