Stay in the loop with our weekly crypto digest as we get you up to speed on the hottest trends and events in the crypto space.

Here’s what happened in crypto this week:

FTX Creditors To Get 10-25% Of Their Crypto Back

Sunil Kavuri, an FTX creditor, revealed new bankruptcy paperwork that indicates that creditors are only likely to receive 10-15% of their crypto holdings.

Despite social media rumors suggesting an FTX reimbursement by September 30th, customers will have to wait an additional week for any updates on repayments. Before FTX can disburse any creditor funds, the court will have to approve its wind-down plan, with the next court hearing scheduled for October 7th.

This refund is based on the value of cryptocurrencies at the time of FTX’s filing, when prices were much lower, with Bitcoin valued at approximately $16,000. This decision has left many creditors feeling disappointed and under-compensated, particularly given the significant growth in crypto values since then.

Ohio Senator Introduces Bill To Allow Senate And Local Taxes To Be Paid With Bitcoin And Crypto

Ohio State Senator Niraj Antani introduced a bill to allow Ohio taxpayers to pay their taxes in Bitcoin and other cryptocurrencies. The proposed legislation would mandate state and local governments to accept crypto as a tax payment method.

In November 2018, Ohio became the first state to accept crypto for tax payments under then-State Treasurer Josh Mandel. However, in November 2019, a ruling by the Ohio Attorney General required the State Board of Deposits to formally approve the policy, stalling the program.

Antani emphasized that the legislation aims to position Ohio at the forefront of technological advancement and economic development. The bill pushes the legislature to act where the board failed to approve crypto use for taxes.

Crypto Companies Begin Geofencing To Block Users In Certain Countries

Crypto companies are increasingly adopting geofencing to navigate regulatory uncertainty, particularly in the US. Geofencing is a strategy to block users from specific regions by creating a virtual “fence,” ensuring compliance with local laws.

According to a Cointelegraph report, Jake Chervinsky, chief legal officer at Variant Fund, describes geofencing as an “extreme solution” but necessary in some cases to avoid US regulatory challenges.

This purpose prevents foreign users from accessing the information when companies cannot meet compliance requirements like disclosures and KYC (Know Your Customer).

Robinhood Launches Crypto Transfers In Europe, Pushing Overseas Expansion

Robinhood is expanding its services in Europe by allowing users to transfer over 20 cryptocurrencies, including Bitcoin and Ethereum, to and from its app, enhancing its product capabilities in the region.

The feature enables European users to self-custody their assets, giving them full ownership over their crypto rather than relying on third-party platforms.

Robinhood’s entry into the EU market comes as it aims to capitalize on the favorable crypto regulations introduced by the EU’s Markets in Crypto-Assets (MiCA) framework, which standardizes rules across member states.

The company plans to acquire Bitstamp to strengthen its global reach and diversify its offerings, but currently, Robinhood’s crypto services are only available to EU customers, excluding the UK.

Bitwise Files For Spot XRP ETF

Asset management firm Bitwise revealed that the company had created a trust as a first step towards filing for an XRP exchange-traded fund (ETF) with the Securities and Exchange Commission (SEC). The filing details were confirmed on the Delaware Division of Corporations website and by a Bitwise spokesperson.

The filing has drawn attention within the crypto community, particularly among those interested in XRP, the digital asset associated with Ripple. XRP has been the subject of regulatory scrutiny in recent years.

While this does not confirm an immediate filing with the SEC, it aligns with Ripple CEO Brad Garlinghouse’s positive outlook on the future of XRP ETFs.

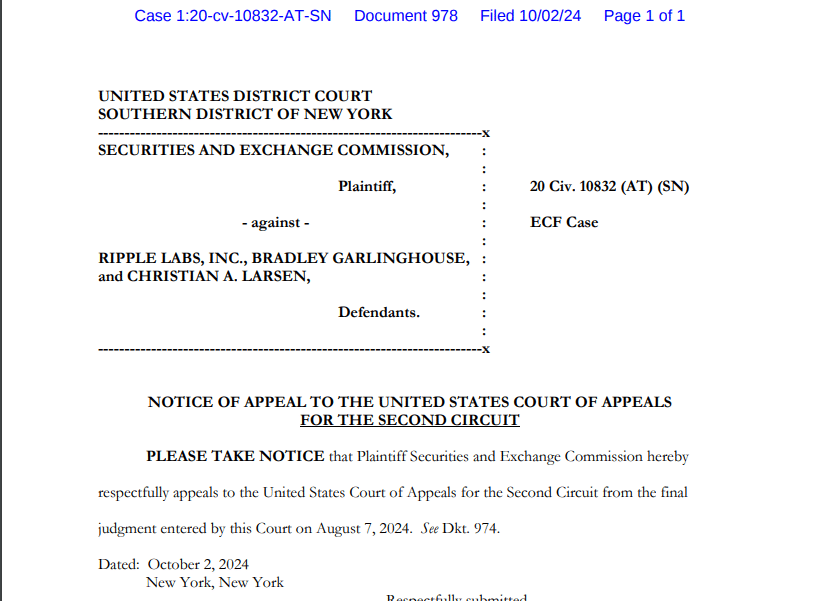

SEC Files Notice Of Appeal In The Ripple And XRP Case

The US SEC has filed a Notice of Appeal to challenge some aspects of Judge Analisa Torres’ July 13th, 2023 ruling in the long-drawn Ripple lawsuit.

The appeal will now move to the US Court of Appeals for the Second Circuit. Legal experts suggest that a final ruling from the appellate court is unlikely to come before early 2026.

Moreover, the SEC’s appeal comes amid broader changes at the agency. Gurbir Grewal, the SEC’s Director of the Division of Enforcement, resigned just hours before the appeal was filed, raising questions about the future direction of the commission’s approach to crypto regulations and enforcement under Chair Gary Gensler’s leadership.

Final Thoughts

So that’s it for this week!

To stay ahead of the game with the freshest crypto news and insights delivered straight to your inbox, consider subscribing to UseTheBitcoin’s newsletter today.

Have a fantastic week ahead!