Key Takeaways

- This article provides an in-depth analysis of the impact of US money printing on the global economy,

- Furthermore, it discusses the potential role of Bitcoin in protecting against these challenges.

Significant attention has been directed to, and broad worries have been raised about, the impact that excessive printing in the United States has had on the economies of other countries. The United States of America has a significant influence over the financial markets over the rest because it has the largest economy in the world.

However, concerns have been raised about the long-term effects of recent monetary policy decisions and the habit of printing an excessive amount of money.

In this article, we will delve into the seven key reasons why quantitative easing is causing growing apprehension around the world. By shedding light on these reasons, we aim to provide a comprehensive understanding of the challenges posed by US overprinting. We will present compelling data and statistics to support our analysis and offer valuable insights into the current state of the global economy.

Inflationary Measures

Quantitative easing results in an expansion of the money supply, which causes inflationary pressures to be exerted.

In 2020, the surge in the Consumer Price Index (CPI) and inflation rates worldwide demonstrated the unintended repercussions of the widespread printing of money during the COVID-19 epidemic.

The sheer quantity of money produced during the past four years has surpassed that of the US’ whole history, which has frightening implications not only for the current generation but also for generations to come.

Currency Devaluation

The United States dollar’s value may decline due to excessive printing of new money into the economy. As a result, the dollar’s purchase power decreases, which increases the cost of products used on a daily basis, such as furniture, clothing, and food. This devaluation has repercussions for transactions both within the country and internationally, and it has an equal impact on consumers and commercial enterprises.

Loss Of Confidence In The US Dollar

Overissuance lowers the credibility of the United States dollar as a reserve currency. The fact that several nations and central banks are moving away from using the US dollar as their primary reserve currency, as well as China‘s ambitions to build its own global reserve currency, highlights the growing mistrust directed toward the stability of the US monetary system. As a consequence of this, nations, organizations, and people all look for ways to hedge their positions by gaining exposure to alternative currencies.

Also Read: 5 Reasons Why Corrupt Governments And Politicians Fear Bitcoin

Asset Bubbles And Speculation

Excess liquidity, caused by the overprinting of currency, can cause asset bubbles. This can both feed speculative activities and inflate asset prices. In 2020 and 2021, this tendency was noticeable in the stock market, the cryptocurrency market, and the real estate industry, as excess liquidity searched for opportunities to invest their funds.

However, these price rises were not fundamentally driven; instead, they were a consequence of the additional money poured into the system. As a direct result, market corrections occurred whenever the liquidity in the market decreased.

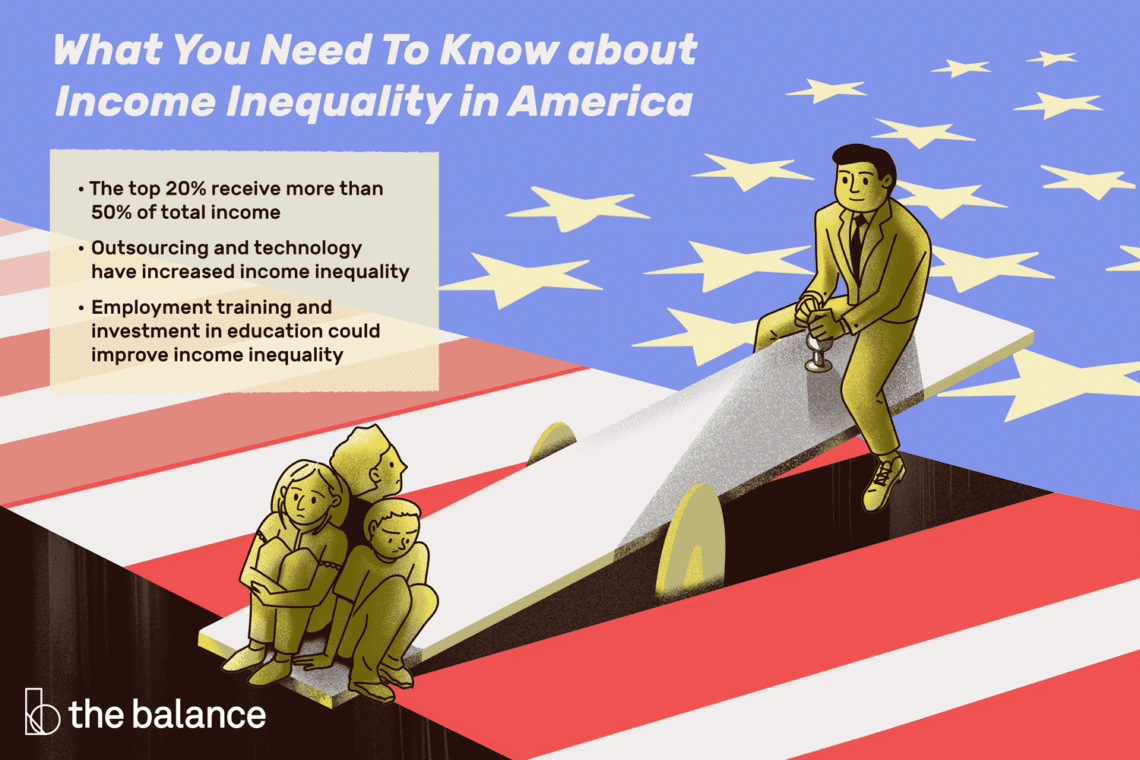

Income Inequality

Overprinting makes the distribution of wealth even more unequal, which benefits existing asset owners. Those with no assets, such as stocks, cryptocurrency, or real estate, see their purchasing power decrease, while those who do have assets see their net worth improve.

The widening gap between the rich and the poor, sustained by massive printing, highlights the significance of asset accumulation as a strategy for protecting and maintaining wealth.

Related: 10 Reasons Why You Should Buy Bitcoin

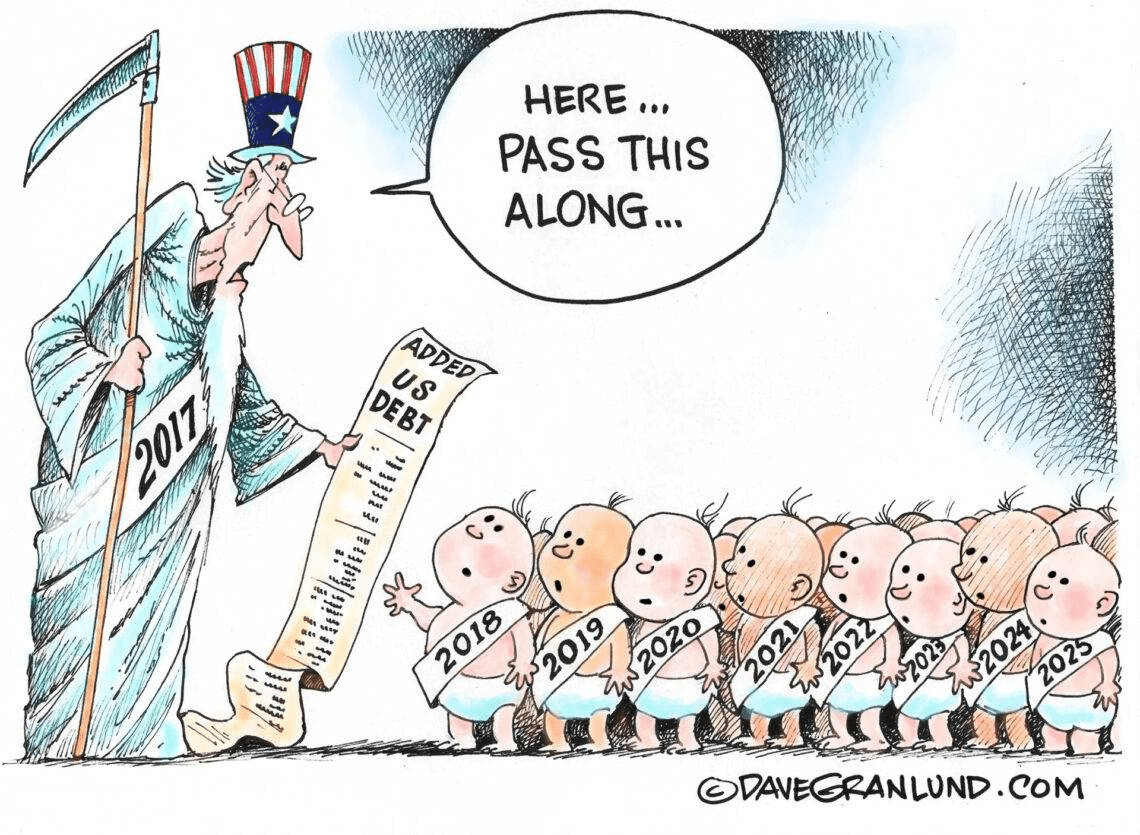

Debt Burden On Future Generations

Excessive printing increases the burden of natural debt, harming future generations. The United States’ national debt is expanding exponentially, and the debt-to-GDP ratio is also rising, indicating that long-term ramifications will harm future generations. The weight of this debt will severely hamper the economy as a whole and the prospects for its continued growth and prosperity in the future.

Global Economic Imbalances

The excessive money printing in the US upsets the world’s economic equilibrium and has ripple consequences. The United States’s monetary policies have a direct impact on trade imbalances, capital flows, and financial vulnerabilities between countries. The implications of these imbalances may have far-reaching ramifications on the economic security of the international community.

The Bottomline

Understanding these seven reasons gives us a deeper comprehension of how the United States’ monetary policies affect the world economy. In light of these concerns, seeking ways to hedge against the risks associated with overprinting becomes crucial.

One such solution is Bitcoin—a scarce, secure, and decentralized digital asset that allows individuals to maintain self-custody over their wealth. Bitcoin serves as a store of value detached from the US monetary system, immune to inflationary pressures, and empowers individuals to protect their assets and wealth over the long term.

Related: What Is Bitcoin (BTC)? All You Need To Know

Final Thoughts

The consequences of overprinting money are already evident and have significantly impacted economies worldwide. The dilution of the dollar’s value and the exacerbation of inequality necessitate a proactive approach to safeguard one’s wealth.

By studying asset classes that serve as a store of value detached from the US monetary system, such as Bitcoin, individuals can find avenues to protect themselves from inflation and secure a fair chance of long-term financial stability.